Forex trading, with its own unique terminology, can seem like a complex world for newcomers.

Understanding these terms is crucial for navigating the markets effectively.

Here are 25 essential forex terms, with examples of Professional Traders to better understand each term and inspire you to become the next Globally Acclaimed Trader!

1. Pip: A pip represents the smallest price movement in the forex market and is typically equivalent to 0.0001 of the quoted currency for most pairs. It stands as the standard unit for measuring how much the exchange rate has changed in value.

Bill Lipschutz, a forex trading titan, demonstrated the power of understanding even the smallest movements, like pips, in the market. Without a formal background in economics or trading, he taught himself and turned $12,000 into hundreds of thousands in university, showing the impact of mastering the basics.

2. Spread: The spread in forex is the difference between the bid (sell) price and the ask (buy) price for a currency pair. It represents transaction costs for traders and varies depending on the currency pair and market conditions.

George Soros, known for his strategic plays against the British Pound in 1992, capitalized on understanding market dynamics, including spreads, to make a billion dollars. His meticulous analysis of market conditions showcases the importance of spreads in executing large-scale trades successfully.

3. Leverage: Leverage allows traders to control a large position with a relatively small amount of capital, magnifying both potential profits and losses. It’s a powerful tool that must be used with caution due to the increased risk of significant losses.

Stanley Druckenmiller, working alongside Soros, used leverage to help execute the trade that broke the Bank of England. His career emphasizes the effective use of leverage in magnifying trades, stressing the importance of risk management and strategic focus.

4. Margin: Margin is the amount of capital required to open and maintain a position in the forex market. It acts as a good faith deposit to cover potential losses on a position and varies according to the size of the trade and the leverage used.

Bruce Kovner started his trading career with a mere $3,000 borrowed against his credit card and turned it into $20,000. His initial foray into trading highlights the critical role margin plays in facilitating trading opportunities.

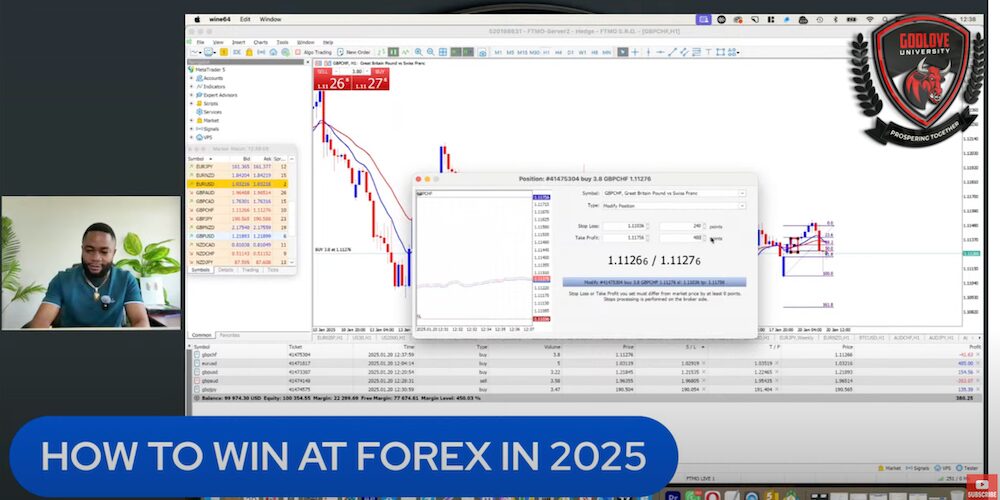

5. Lot Size: In forex, a lot size refers to the number of currency units you are buying or selling. The standard lot size is 100,000 units of the base currency, but there are also mini, micro, and nano lots available for smaller trades.

Understanding and utilizing lot sizes effectively, as demonstrated by Kovner’s initial trades, allowed him to maximize returns from his leveraged position. It’s a testament to the strategic calculation of trade volume in pursuit of significant gains.

6. Bid and Ask: The bid price is what buyers are willing to pay for a currency pair, while the ask price is what sellers are willing to accept. The difference between these two prices is the spread.

Paul Tudor Jones, renowned for his prediction and capitalization on the 1987 stock market crash, demonstrates the significance of bid and ask prices in trading. His approach to trading, focused on macroeconomic trends and market cycles, necessitates a deep understanding of these fundamental concepts.

7. Bear Market: A bear market in forex signifies a period where prices are falling, indicating a downturn in market sentiment. Traders may look to sell or short-sell currency pairs expecting further declines.

8. Bull Market: Conversely, a bull market represents a period of rising prices, reflecting positive market sentiment. Traders may look to buy currency pairs anticipating further gains.

The contrasting market conditions have been navigated successfully by traders like Richard Dennis, who trained a group of novices, known as the “Turtle Traders,” to generate over $100 million. Their success in both bear and bull markets showcases the effectiveness of trend-following strategies and risk management.

9. Volatility: Volatility refers to the degree of variation in the price of a currency pair over a specific time period. High volatility means significant price movements, while low volatility indicates lesser price changes.

Ed Seykota, one of the pioneers of computerized trading systems, capitalized on market volatility to amass significant wealth. His use of electronic systems to trade in volatile markets underscores the importance of adapting to market dynamics.

10. Currency Pair: A currency pair compares the value of one currency to another, indicating how much of the quote currency is needed to purchase one unit of the base currency. It’s the fundamental element of forex trading.

Lipschutz’s success at Salomon Brothers, where he generated substantial profits from forex trading, exemplifies the importance of choosing the right currency pairs and understanding their behavior to maximize trading effectiveness.

11. Major Pairs: Major pairs involve the USD paired with other significant currencies like EUR, JPY, GBP, and are known for their liquidity and lower spreads compared to other pairs.

12. Cross Pairs: Cross pairs do not include the USD. They offer opportunities to trade directly between non-USD currencies, often with higher spreads due to less liquidity.

13. Exotic Pairs: Exotic pairs consist of one major currency and one currency from a developing or smaller economy. These pairs typically have higher spreads and volatility.

14. Equity: Equity in a forex account is the current value of a trader’s account when all open positions are closed. It fluctuates with market movements and open trade positions.

15. Free Margin: Free margin is the amount of money in a trading account available to open new positions, calculated as equity minus the margin used for open positions.

16. Swap: A swap in forex is an overnight interest paid or earned for holding positions overnight, varying according to the interest rate differential between the two currencies in a pair.

17. Order: In forex, an order is an instruction to buy or sell a currency pair at a specified price or better. Various types of orders are used to execute trading strategies.

18. Stop Loss: A stop-loss order is designed to limit an investor’s loss on a position. It automatically closes a trade at a predetermined price to prevent further losses.

19. Take Profit: A take-profit order automatically closes a trade at a predetermined price once a specific level of profit has been achieved, securing gains.

20. Scalping: Scalping is a trading strategy focused on making profits from small price changes, requiring quick entry and exit decisions.

21. Day Trading: Day trading involves opening and closing trades within the same trading day, aiming to profit from short-term price movements.

22. Position Trading: Position trading is a long-term strategy where traders hold positions for weeks to months, focusing on the asset’s fundamental trends rather than short-term price movements.

23. Technical Analysis: This analysis uses past market data, charts, and mathematical indicators to forecast future price movements and identify trading opportunities.

24. Fundamental Analysis: Fundamental analysis assesses currencies by examining economic indicators, monetary policies, and political events that could affect currency values.

25. Risk Management: Risk management involves identifying potential financial risks and implementing strategies to minimize or mitigate those risks in trading activities.

We, at Godlove University, trust you found this article informative, and that it adds more knowledge and ultimately success to your trading.