Navigating the Forex Seas Safely

The world of trading,

especially in the volatile Forex market, demands not just skill and strategy but a strong emphasis on risk management. Effective risk management is the linchpin for long-term success in trading. In this comprehensive guide, we’ll dive into the top risk management tips that every trader, whether novice or experienced, should implement to safeguard their investments.

Understanding the Basics: What is Risk Management?

Before delving into strategies, it’s crucial to understand what risk management in trading entails. It’s a systematic approach to identifying, assessing, and mitigating financial losses in trading. Effective risk management ensures that a trader can survive the rough patches and capitalize on the winning streaks.

Tip 1: Set Realistic Risk/Reward Ratios

One of the cornerstones of risk management is setting and adhering to realistic risk/reward ratios. This means deciding how much risk you’re willing to take for a potential reward. A common approach is to never risk more than 2% of your account balance on a single trade.

Calculating Risk/Reward Ratios

Understand the formula and methods to calculate the risk/reward ratio effectively. This calculation should guide your trading decisions and help in setting stop-loss orders.

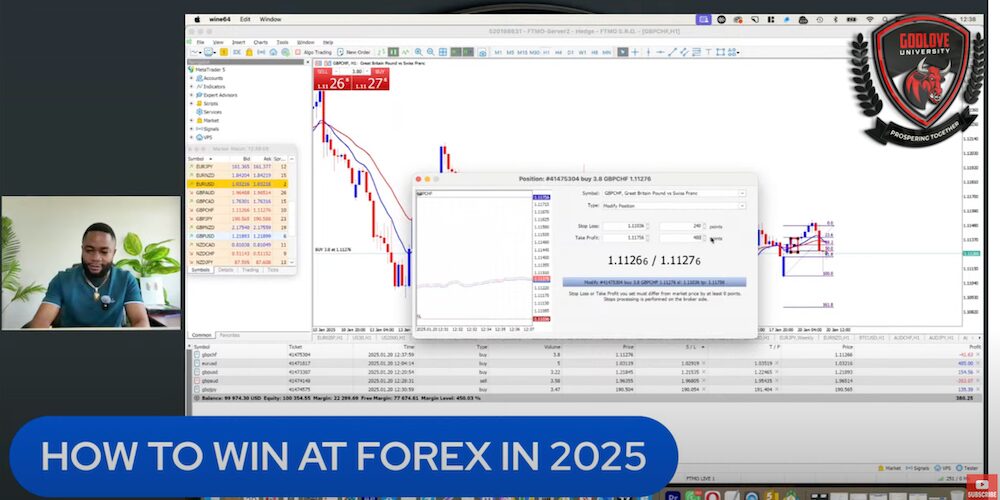

Tip 2: Utilize Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are crucial tools for risk management. They automatically close a trade at a predetermined level to either lock in profits or limit losses.

The Importance of Consistent Orders

Consistency in using these orders protects your investments from sudden market movements and emotional decision-making.

Tip 3: Diversify Your Portfolio

Forex trading and investing involve uncertainty, which is why diversification can be a sound risk management strategy. Diversifying basically means trading or investing in multiple uncorrelated currency pairs at the same time. When trading, some of your trade ideas will work out while others will not. But diversifying into different assets or currency pairs can help spread the risk and compensate for those losing trades. The goal of diversification is to create a balanced portfolio of assets that don’t have a strong positive or negative correlation with price performance.

This is a good way to manage risk, but don’t get carried away with it without considering some of the other tips I am going to mention. But there is an old adage you might have heard before that expresses this tip quite well. That is, don’t put all your eggs in one basket.

Tip 4: Regularly Review and Adjust Strategies

The Forex market is dynamic. Regularly reviewing and adjusting your trading strategies in response to market changes is essential.

Adapting to Market Trends

Stay updated with the latest market trends and economic news to make informed adjustments to your trading approach.

Tip 5: Educate Yourself Continuously

Continuous education is crucial in trading. Stay informed about the latest tools, strategies, and market developments.

Leveraging Educational Resources

Utilize courses, webinars, and other educational resources to keep your knowledge up-to-date.

Building a Fortress Around Your Investments

Implementing these risk management tips can significantly enhance your trading strategy, turning it into a more secure and potentially profitable endeavor. Remember, risk management in forex trading isn’t just a tactic; it’s an integral part of your trading DNA.

In summary, risk management in forex trading is about making calculated decisions, staying disciplined, and being prepared for market fluctuations. By integrating these tips into your trading practice, you’re not just protecting your investments but also setting the stage for sustainable success in the ever-changing world of forex.

4 Responses

This is nice.

Very honest and not over promising to the world that forex is only the land of success.

I like your honesty and ensures we are aware that losses can always happen. But in order to mitigate them or reduce we must be cautious and set realistic expectations and have our risks in order.

Regards,

L.Gumede

Thank you for the comment, L. Gumede. You are right setting realistic expectations is a must!

I’m on my way to being a pro, love the content of your blogs!

Perfect well explained thank you