Introduction

Finally, we answer the question: Can Forex Trading make you rich? In the previous parts of our series, we examined the fundamentals of Forex trading, advanced strategies, and effective risk management techniques. In this final part, we will explore the psychological aspects of trading, the importance of continuous learning, and the role of automation in Forex trading. Understanding these elements is crucial for maintaining a disciplined approach and achieving long-term success in the dynamic Forex market.

Psychological Aspects of Forex Trading

The Impact of Emotions on Trading

Emotions such as fear, greed, and overconfidence can significantly impact trading decisions. Fear may cause traders to exit positions prematurely, while greed can lead to overtrading and taking excessive risks. Overconfidence may result in ignoring risk management principles, leading to substantial losses.

Developing Emotional Discipline

Developing emotional discipline involves recognizing and managing emotions to make rational trading decisions. Traders should adhere to their trading plans, set realistic goals, and avoid impulsive actions driven by emotions. Techniques such as mindfulness and stress management can help maintain emotional balance.

Overcoming Psychological Barriers

Psychological barriers, such as fear of failure and loss aversion, can hinder trading performance. Overcoming these barriers requires a positive mindset, self-confidence, and the ability to learn from mistakes. Setting achievable goals and celebrating small successes can boost confidence and motivation.

The Importance of Continuous Learning

Staying Updated with Market News

The Forex market is influenced by various economic, political, and social factors. Staying updated with market news and events helps traders make informed decisions and anticipate market movements. Regularly reading financial news, following economic reports, and participating in market analysis forums can enhance market knowledge.

Enhancing Trading Skills

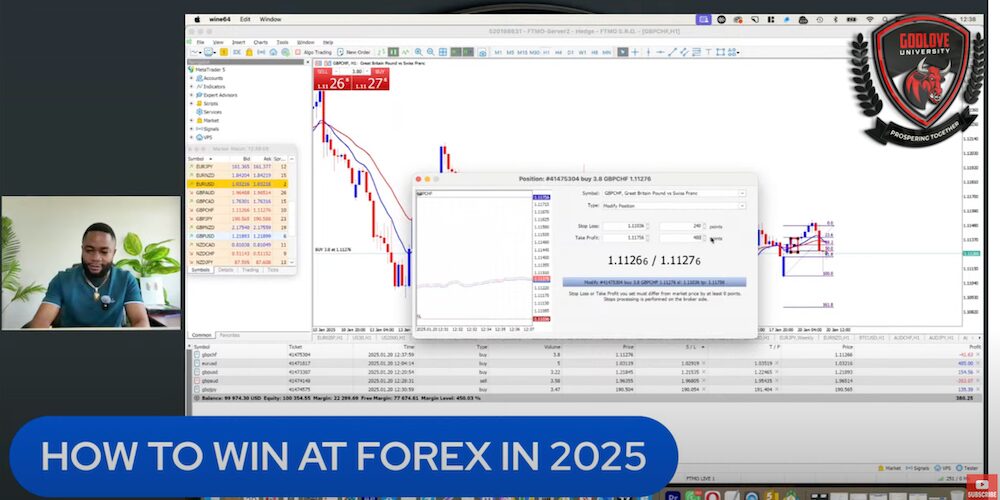

Continuous learning involves improving trading skills through education and practice. Traders should regularly review their trading performance, identify areas for improvement, and seek knowledge from reputable sources. Participating in trading courses, webinars, and workshops can provide valuable insights and practical skills.

Adapting to Market Changes

The Forex market is dynamic and constantly evolving. Adapting to market changes involves staying flexible and adjusting trading strategies based on market conditions. Traders should be open to learning new techniques and approaches to stay competitive and profitable.

The Role of Automation in Forex Trading

Introduction to Automated Trading

Automated trading involves using computer programs to execute trades based on predefined criteria. These programs, known as trading algorithms or bots, can analyze market data, identify trading opportunities, and execute trades automatically.

Benefits of Automated Trading

Automated trading offers several benefits, including:

- Consistency: Eliminates emotional decision-making and ensures adherence to trading plans.

- Speed: Executes trades faster than manual trading, capturing opportunities promptly.

- Efficiency: Monitors the market 24/7, identifying opportunities even when traders are unavailable.

Implementing Automated Trading

To implement automated trading, traders should:

- Choose a Reliable Trading Platform: Select a platform that supports automated trading and offers robust security features.

- Develop or Purchase Trading Algorithms: Develop custom algorithms based on trading strategies or purchase pre-built algorithms from reputable providers.

- Test and Optimize: Test the algorithms using historical data and optimize them for better performance.

Risks and Considerations

While automated trading offers advantages, it also involves risks. Traders should:

- Monitor Performance: Regularly monitor the performance of trading algorithms to ensure they are functioning correctly.

- Manage Risks: Implement risk management techniques, such as setting stop-loss orders and position sizing, to mitigate potential losses.

- Stay Informed: Continuously stay informed about market conditions and adjust algorithms as needed.

Conclusion

So, can forex trading make you rich? Definitely. Forex trading can be a path to wealth creation, but it requires a comprehensive understanding of the market, advanced strategies, effective risk management, and psychological discipline. By continuously learning and adapting to market changes, traders can enhance their performance and achieve long-term success. The integration of automated trading can further improve efficiency and consistency in trading.

This concludes our series on whether Forex trading can make you rich. By implementing the insights and techniques discussed in these articles, you can embark on a successful Forex trading journey and unlock the potential for substantial profits.

Frequently Asked Questions

Can emotions impact Forex trading? Yes, emotions such as fear, greed, and overconfidence can significantly impact trading decisions, leading to poor outcomes. Managing emotions is crucial for making rational decisions.

Why is continuous learning important in Forex trading? Continuous learning helps traders stay updated with market news, improve trading skills, and adapt to changing market conditions. It is essential for long-term success.

What is automated trading in Forex? Automated trading involves using computer programs, known as trading algorithms or bots, to execute trades based on predefined criteria. It offers benefits such as consistency, speed, and efficiency.

How can I develop emotional discipline in trading? Developing emotional discipline involves recognizing and managing emotions, adhering to trading plans, and avoiding impulsive actions. Techniques such as mindfulness and stress management can help.

What are the benefits of automated trading? Automated trading eliminates emotional decision-making, executes trades faster than manual trading, and monitors the market continuously, identifying opportunities even when traders are unavailable.

How can I implement automated trading? To implement automated trading, choose a reliable trading platform, develop or purchase trading algorithms, and test and optimize them for better performance. Regularly monitor performance and manage risks.

Explore the world of Forex Trading Strategies with our Forex A to Z Course

Learn more about Trading Psychology

Ready to Automate your Trading? Meet our Award Winning Forex Bot, Patrex Pro

Read more about Risk Management

Have a look at our Tools, developed especially for Traders:

Forex Trading Calculators, including a Pip Calculator, Lot Size Calculator, Position Size Calculator, Profit Calculator

Forex Economic Events Calendar

Forex Sentiment Analysis

Forex Market Hours