As we conclude our series on candlestick patterns, this final part delves into the most advanced strategies and real-world applications of candlestick patterns in trading. With a solid foundation from Parts 1 and 2, we now explore expert techniques and insights that can elevate your trading game.

Candlestick patterns are not just tools for novice traders; they are powerful indicators that, when mastered, can offer significant advantages even to seasoned traders. By understanding these advanced patterns and integrating them into sophisticated trading strategies, traders can make more informed decisions and achieve better results

Advanced Candlestick Patterns

Beyond the basic and intermediate patterns, advanced candlestick patterns provide deeper insights into market dynamics. These patterns often signal strong reversals or continuations and can be pivotal in decision-making.

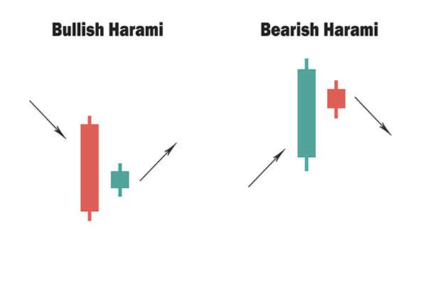

The Harami Pattern

The Harami pattern is a reversal pattern that can be either bullish or bearish. A Bullish Harami occurs during a downtrend and consists of a large bearish candlestick followed by a smaller bullish candlestick that is entirely within the body of the first. This pattern suggests a potential reversal to an uptrend. Conversely, a Bearish Harami appears in an uptrend, with a large bullish candlestick followed by a smaller bearish candlestick, indicating a possible reversal to a downtrend.

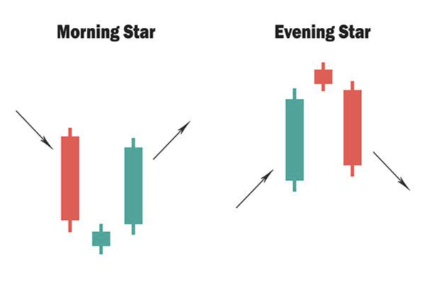

The Morning and Evening Stars

The Morning Star is a bullish reversal pattern that consists of three candlesticks: a long bearish candlestick, a short-bodied candlestick that gaps down, and a long bullish candlestick. This pattern signifies a strong reversal from a downtrend to an uptrend. The Evening Star is its bearish counterpart, indicating a reversal from an uptrend to a downtrend.

Expert Strategies Using Candlestick Patterns

Combining candlestick patterns with other technical indicators and trading principles can lead to robust trading strategies. Here, we discuss some expert techniques that leverage the power of candlestick patterns.

Confluence Strategies

Confluence occurs when multiple indicators or patterns align to confirm a trading signal. For example, if a Bullish Engulfing pattern appears at a major support level, and the RSI is also indicating oversold conditions, the probability of a successful trade increases. Confluence strategies enhance the reliability of trading signals and can significantly improve trading performance.

Trend Following with Candlestick Patterns

Trend following involves identifying and trading in the direction of the prevailing market trend. Candlestick patterns can help traders enter and exit trades within the trend. For instance, during an uptrend, traders might look for Bullish Engulfing or Three White Soldiers patterns to confirm entry points. Conversely, in a downtrend, patterns like the Three Black Crows or Bearish Engulfing can signal entry points for short trades.

Reversal Trading Strategies

Reversal trading focuses on identifying points where the current trend is likely to reverse. Advanced candlestick patterns such as the Morning Star, Evening Star, and Abandoned Baby are critical in these strategies. For instance, spotting an Abandoned Baby pattern at the end of an uptrend can provide an excellent shorting opportunity. Combining these patterns with indicators like MACD or Fibonacci retracement levels can enhance the strategy’s effectiveness.

Conclusion

Frequently Asked Questions

What is the Harami pattern?

The Harami pattern is a reversal pattern that can be either bullish or bearish. It consists of a large candlestick followed by a smaller one that is entirely within the body of the first, indicating a potential reversal.

How can the Morning Star pattern be used in trading?

The Morning Star is a bullish reversal pattern that indicates a potential shift from a downtrend to an uptrend. Traders can use it to identify buying opportunities, especially when confirmed by other indicators.

How do confluence strategies work in trading?

Confluence strategies involve using multiple indicators or patterns to confirm a trading signal. This approach enhances the reliability of the signals and improves trading performance.

What is the difference between trend following and reversal trading?

Trend following involves trading in the direction of the prevailing trend, while reversal trading focuses on identifying points where the current trend is likely to reverse. Both strategies can be enhanced using candlestick patterns.

Can candlestick patterns be used in forex trading?

Yes, candlestick patterns are widely used in forex trading. They help traders understand market sentiment and predict potential price movements, making them valuable tools in forex analysis.