In the fast-paced world of forex trading, mastering analytical tools can significantly enhance your trading strategies and outcomes. Among these tools, Elliott Wave Theory stands out as a sophisticated and insightful approach to understanding market cycles and predicting future price movements. This comprehensive guide dives deep into the intricacies of Elliott Wave Theory in Forex trading, offering traders at all levels a roadmap to leverage this powerful analysis technique for improved decision-making.

Introduction to Elliott Wave Theory

Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, is a method of technical analysis that traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. At its core, the theory suggests that market movements are not random but follow a natural rhythm of psychological waves, consisting of impulse waves and corrective waves, that reflect the overall sentiment of the market.

The Basics of Elliott Wave Theory in Forex Trading

Forex markets, characterized by their volatility and liquidity, present an ideal setting for applying Elliott Wave Theory. The theory posits that markets move in repetitive cycles, which Elliott described as waves. These waves are divided into two main types:

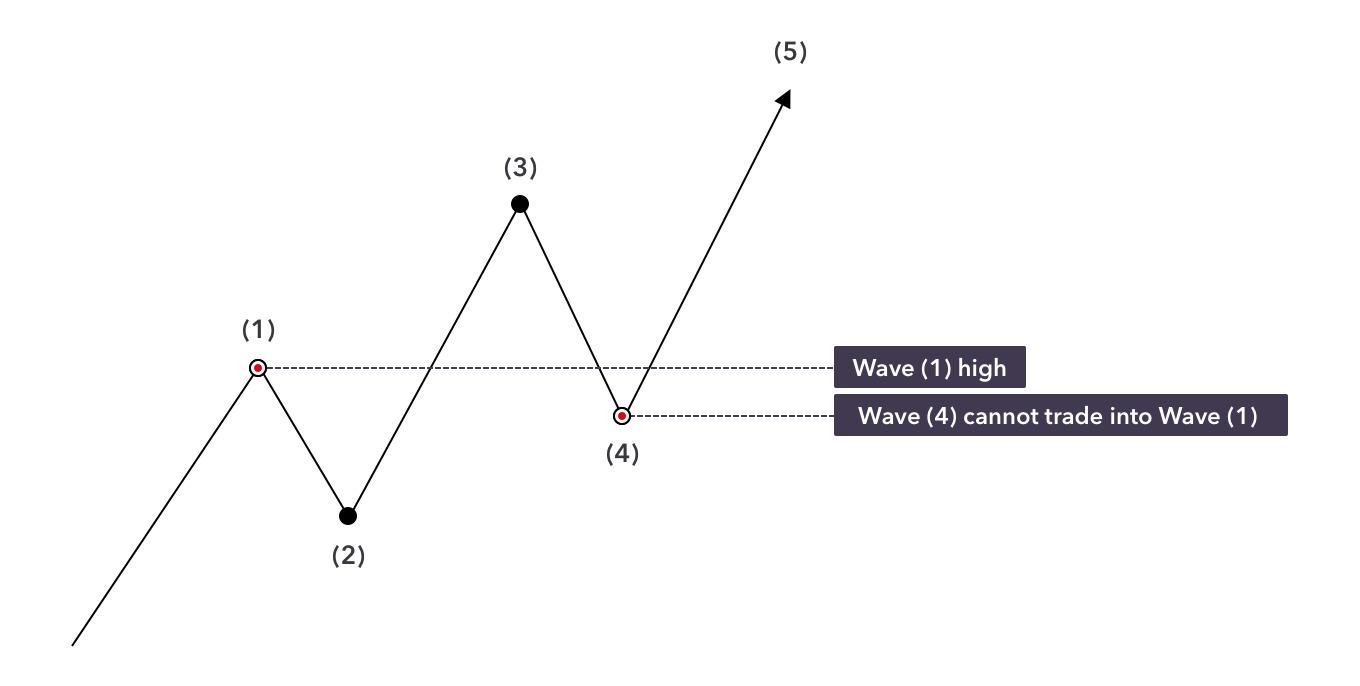

Impulse Waves:These are the waves that move in the direction of the overall trend and are typically comprised of five sub-waves.

Corrective Waves:Waves that move against the trend, usually in a three-wave pattern.

Understanding and identifying these waves can provide Forex traders with insights into potential market directions, helping them to make informed trading decisions.

Applying Elliott Wave Theory to Forex Trading

Mastering Elliott Wave Theory requires patience and practice. Here are the key steps to effectively applying the theory to your forex trading strategy:

Identify the Wave Patterns:Start by identifying the beginning of a wave cycle at significant market highs or lows. Look for the five-wave impulse pattern followed by a three-wave corrective pattern.

Determine the wave degree: Elliott waves are fractal, meaning they can be broken down into smaller wave structures. Identifying the degree of the current wave is crucial for understanding its position within the overall market cycle.

Forecast Market Direction: Use your wave analysis to predict potential turning points in the market. This involves interpreting the wave patterns and their implications for future price movements.

Develop a Trading Strategy: Incorporate Elliott Wave analysis into your trading strategy. Use it to identify entry and exit points, stop-loss levels, and to manage risk.

Tips for Mastering Elliott Wave Theory

Practice Makes Perfect: Spend time analyzing charts and identifying wave patterns in historical data.

Use Supporting Indicators: Combine Elliott Wave analysis with other technical indicators to confirm your wave count and market predictions.

Stay Updated: Keep abreast of global economic news and events, as they can have significant impacts on forex markets and wave patterns.

Join a community: Engage with other traders who use Elliott Wave Theory. Sharing insights and strategies can enhance your understanding and application of the theory.

Conclusion

Elliott Wave Theory offers Forex traders a profound insight into market dynamics, enabling them to anticipate changes in market sentiment and adjust their strategies accordingly. While mastering this theory requires dedication and practice, the potential rewards in terms of improved trading accuracy and decision-making are considerable. By diligently applying Elliott Wave analysis, traders can unlock a deeper understanding of market movements, positioning themselves for success in the volatile world of Forex trading.

Incorporate this powerful tool into your trading arsenal and start navigating the Forex markets with confidence and precision. Remember, the key to success in forex trading lies not just in the tools you use but in your persistence, adaptability, and continuous learning.

One Response

I remember back in the days,this was the most troubling strategy to grasp 😂..I almost gave up on forex cuz of Elliot’s waves..Thanks for throwing light on this and breaking it down ..The key success in forex realy lies not just in the tools but in persistence,consistency,adaptabiliy and continous learnin..Thank you