In the ever-evolving world of Forex trading, staying ahead of the curve is essential for success. As we step into 2024, mastering the art of trading requires a deep understanding of the most effective tools at our disposal. In this comprehensive guide, we’ll explore the top 5 Forex indicators poised to dominate the scene in 2024, along with insightful tips on how to use them.

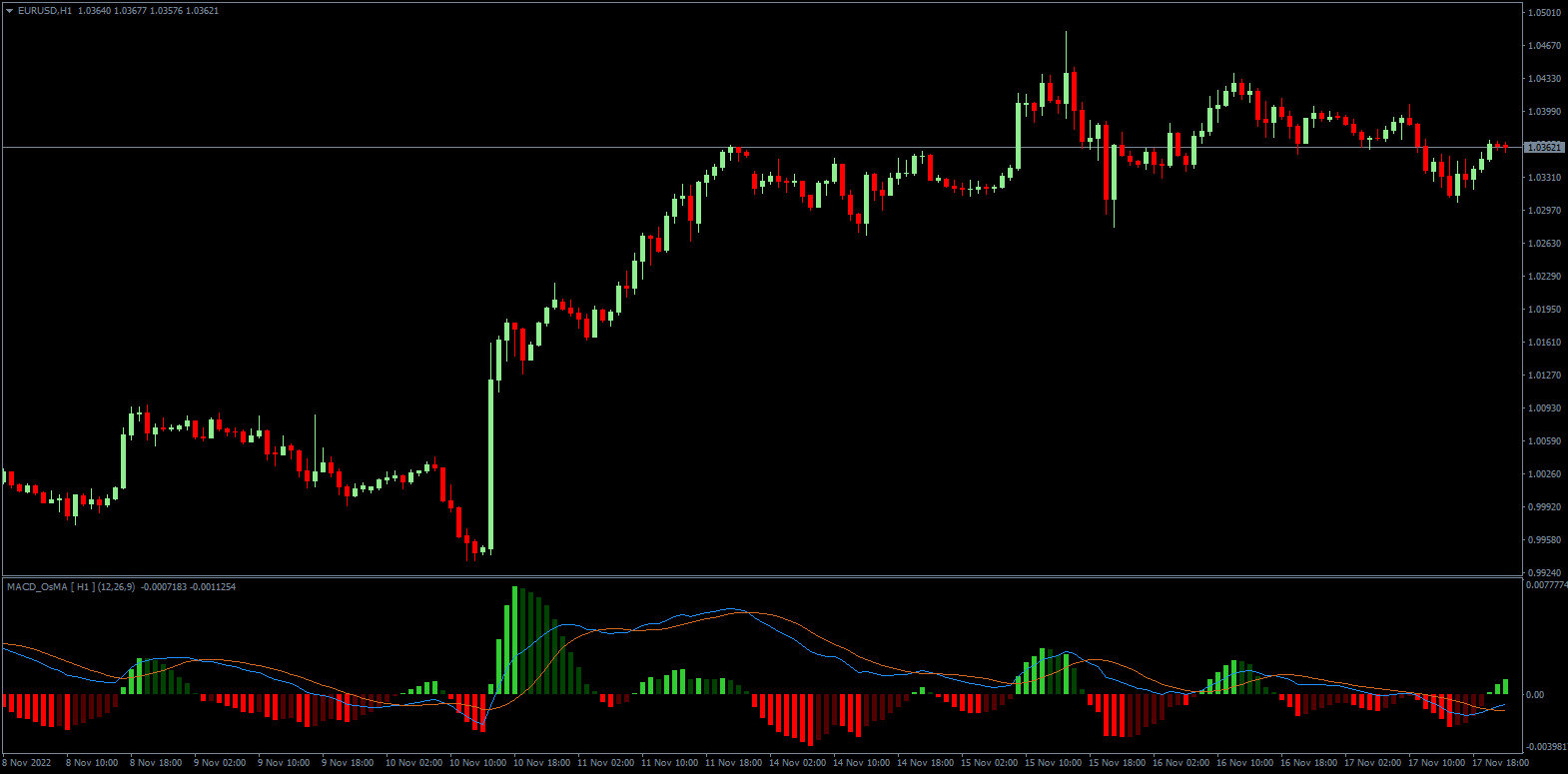

1. Moving Average Convergence Divergence (MACD):

MACD remains a cornerstone indicator for traders seeking insights into trend direction and momentum. Comprising two lines – the MACD line and the signal line – this indicator provides valuable information about potential trend reversals and market strength. Incorporate MACD crossovers and histogram analysis into your strategy to identify entry and exit points with greater precision. the MACD indicator is often used to identify divergences. A divergence occurs when the security’s price makes a higher high, or a lower low, that is not supported by the histogram also making a higher high or a lower low. A divergence hints at the change in the price direction.

2. Relative Strength Index (RSI):

A stalwart in the world of technical analysis, RSI helps traders gauge the overbought or oversold conditions of a currency pair. With values ranging from 0 to 100, RSI highlights potential reversal points. Learn how to interpret RSI levels to anticipate trend changes and fine-tune your trading decisions accordingly. The RSI is no stranger to the concept of divergence. If the security’s price makes a higher high, while the RSI only makes a lower high, a bearish signal is generated and vice versa.

3. Fibonacci Retracement:

Harnessing the power of Fibonacci sequences, this indicator aids in identifying potential support and resistance levels. By drawing retracement levels on a price chart, traders can anticipate where a trend might reverse, offering strategic entry and exit points. Learn the art of Fibonacci retracement to add a powerful tool to your technical analysis arsenal. The underlying principle of any Fibonacci tool is a numerical anomaly that is not grounded in any logical proof. The ratios, integers, sequences, and formulas derived from the Fibonacci sequence are only the product of a mathematical process. That does not make Fibonacci trading inherently unreliable. However, it can be uncomfortable for traders who want to understand the rationale behind a strategy.

4. Bollinger Bands:

Bollinger Bands provide a visual representation of volatility and potential price extremes. Comprising a middle band (SMA) and upper/lower bands representing standard deviations, Bollinger Bands help traders identify periods of high or low volatility. Explore how to interpret Bollinger Band squeezes and expansions for more informed trading decisions. When the prices are near the upper deviation line, the market is considered overbought and when at the lower deviation line, the market is considered oversold. Furthermore, in a more volatile market, the Bollinger Bands will widen and in a less volatile market, they will contract.

5. Ichimoku Cloud:

Offering a comprehensive view of support, resistance, and trend direction, the Ichimoku Cloud is a versatile indicator that combines multiple components. From the Tenkan and Kijun lines to the Senkou Span and Chikou Span, understanding the components of the Ichimoku Cloud can enhance your ability to identify trend direction and potential reversals. Traders will often use the Ichimoku Cloud as an area of support and resistance depending on the relative location of the price. The cloud provides support/resistance levels that can be projected into the future. This sets the Ichimoku Cloud apart from many other technical indicators that only provide support and resistance levels for the current date and time.

As we navigate the complexities of Forex trading in 2024, mastering these top 5 indicators can set you on a path to success. Remember, successful trading requires a combination of technical expertise, strategic thinking, and adaptability. Stay informed, practice diligently, and let the synergy of traditional indicators and cutting-edge AI technologies guide you to profitable ventures in the dynamic world of Forex trading. Happy trading!

8 Responses

What a comprehensive and insightful post on forex indicators! As someone who navigates the complex world of forex trading, I found your analysis of different indicators particularly enlightening. Your explanation of how tools like Moving Averages, RSI, and MACD work in concert to provide a more rounded view of the market is spot on.

I particularly appreciate the way you’ve highlighted the importance of not relying on a single indicator in isolation. As you rightly pointed out, the synergy of multiple indicators not only enhances the accuracy of market predictions but also helps in mitigating risk, which is crucial in forex trading.

One aspect that resonated with me was the section on the importance of understanding the context behind the indicators. As traders, it’s easy to get lost in the technicalities and forget that these tools are just one part of a bigger picture that includes economic, political, and global events.

Your blog serves as a great reminder that while indicators are valuable tools, they are most effective when used in combination with a solid understanding of the market and its underlying principles. I’m looking forward to implementing some of your suggestions in my trading strategy and I’m eager to read more of your insights on this topic.

Thank you for sharing your expertise! Keep up the great work.

Dear valued reader,

Thank you so much for your thoughtful and encouraging feedback! As the admin of our blog, I’m thrilled to hear that you found our post on forex indicators comprehensive and insightful. It’s always our goal to provide valuable and practical information to our readers, especially in the complex world of forex trading.

I’m glad you appreciated our emphasis on the importance of using multiple indicators in concert and not relying on a single one in isolation. As you rightly pointed out, this approach not only enhances the accuracy of market predictions but also plays a crucial role in risk mitigation – a key aspect of successful forex trading.

It’s wonderful to hear that the section on understanding the context behind indicators resonated with you. We believe that a holistic view, considering economic, political, and global events alongside technical indicators, is essential for making informed trading decisions.

We’re delighted to know that you plan to implement some of the suggestions from our blog into your trading strategy. Remember, continuous learning and adaptation are key in the dynamic forex market. We’ll certainly strive to provide more insights and analyses on this topic in the future to support your trading journey.

Once again, thank you for your kind words and for being a part of our community. If you have any specific topics or questions you’d like us to cover in future posts, please feel free to let us know. Happy trading, and we look forward to bringing you more valuable content!

This is awesome. I am going for nothing less than a million in forex in 2024. the goal might be big but the forex market is big as well. Thank you for the detailed article on how to make money in forex or win at forex in 2024.

Thank you for your enthusiastic comment! We’re thrilled to hear that you found our article on making money in forex helpful and inspiring. Setting ambitious goals, such as reaching a million in forex by 2024, is a commendable pursuit, and we wish you the best of luck on your trading journey.

Remember, success in the forex market often requires a combination of knowledge, strategy, and disciplined execution. Stay focused, continue learning, and adapt to market conditions. If you have any questions or need further guidance along the way, feel free to reach out. We’re here to support you on your path to success in forex trading.

Happy trading, and may 2024 be a prosperous year for you!

I am generally not a big fan of indicators but these highlighted here are certainly worth a look into. I do like using the Fibonacci indicator together with a Fibonacci strategy. Also I think that the Ichimoku Cloud which provides support and resistance ‘zones’ instead of defined lines or values is extremely valuable to place Stop loss and Take Profit levels whilst still allowing the market to ‘breathe’

Thank you for sharing your thoughts on indicators. It’s always great to hear different perspectives on trading strategies. We appreciate your input.

It’s interesting that you find value in using the Fibonacci indicator and strategy together. The Fibonacci retracement levels indeed offer a unique way to identify potential reversal points in the market.

Additionally, your mention of the Ichimoku Cloud is spot on. Many traders appreciate its ability to provide a holistic view of support and resistance, offering a dynamic perspective with its ‘zones.’ Using it to set Stop Loss and Take Profit levels while allowing room for market fluctuations is a thoughtful approach. It aligns well with the idea of letting trades breathe and avoiding overly rigid constraints.

We encourage our readers to explore various indicators and strategies, finding what works best for their individual trading styles and risk tolerance. Feel free to share more insights or strategies that you find effective. We love fostering a community where traders can exchange ideas and learn from each other’s experiences.

Happy trading!

Which are the best ones for accuracy and decreased lag?

How can i get the perfect settings for these indicators?

Is there someone that can guide me please?

Thank You So Much

We appreciate your interest in achieving the best accuracy and decreased lag for your indicators. Optimizing settings can be crucial for a seamless experience.

To assist you further, we recommend providing specific details about the indicators you are using and the platform or software you are working with. Different indicators and platforms may have unique settings and configurations.

In the meantime, consider the following general tips to improve accuracy and reduce lag:

Update Software: Ensure that you are using the latest version of the indicator software. Developers often release updates to enhance performance.

Hardware Considerations: Check if your hardware meets the system requirements. Upgrading your computer or device might improve overall performance.

Network Stability: A stable internet connection is essential. Lag can sometimes be attributed to network issues, so make sure you have a reliable and high-speed connection.

Adjust Indicator Settings: Explore the settings within the indicator software. Depending on the specific indicator, you may find options to tweak parameters that affect accuracy and responsiveness.

Community Forums and Support: Many indicator platforms have active communities or support forums. Engaging with fellow users can provide valuable insights, and you might find guides or tutorials tailored to your specific needs.

If you have specific questions or need guidance on a particular indicator, please provide more details, and our community or support team will do their best to assist you.