In the intricate tapestry of technical analysis, certain patterns emerge with the promise of profound insights. One such pattern, the Dragonfly Doji, is a harbinger of potential market shifts, offering traders a glimpse into the subtle balance of power between buyers and sellers. Understanding and effectively utilizing the Dragonfly Doji can be a significant asset in a trader’s arsenal. This blog aims to demystify this intriguing candlestick pattern and provide practical tips on leveraging it for trading success.

What is the Dragonfly Doji?

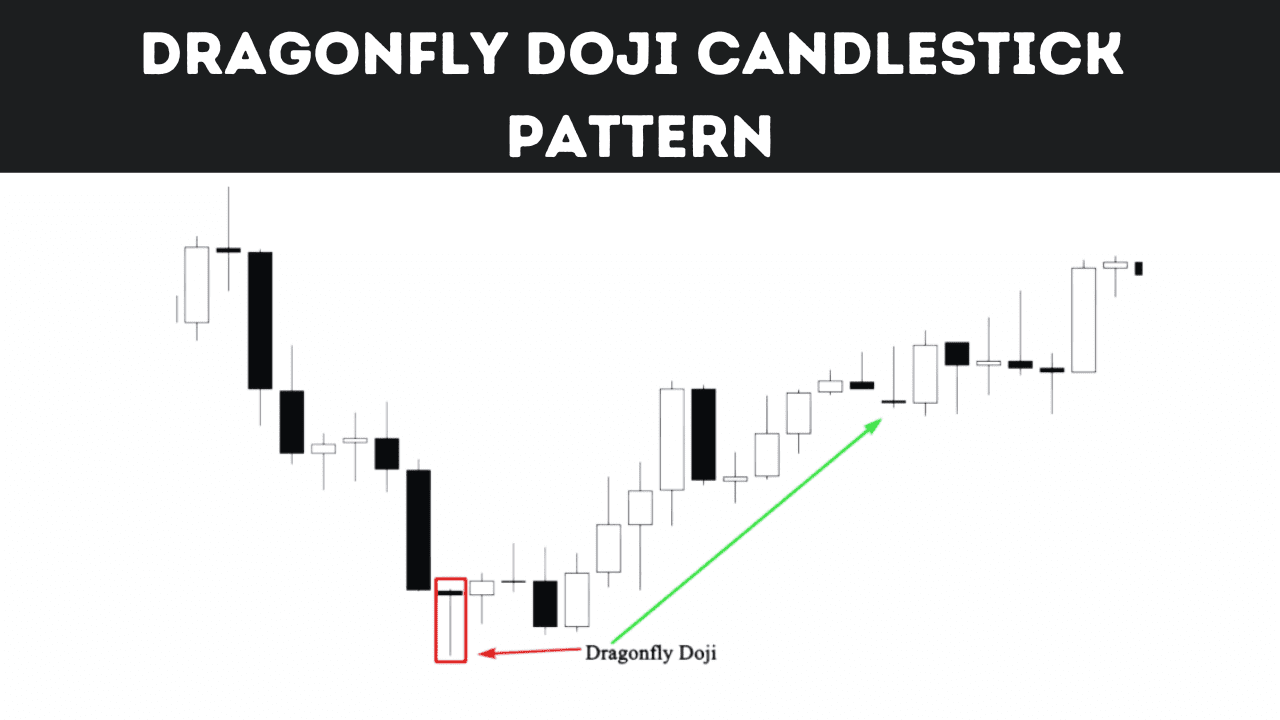

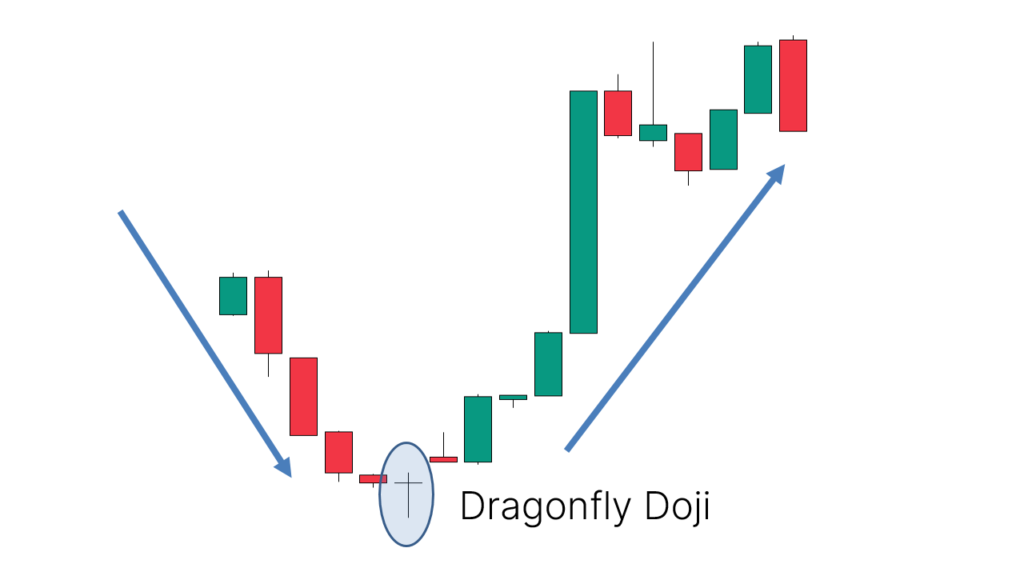

The Dragonfly Doji is a unique candlestick pattern characterized by its ‘T’ shape. It occurs when the open, high, and close prices are the same or about the same price. The long lower shadow suggests that the market tested to find where support and demand were located and then found it. When the Dragonfly Doji appears at the end of a downtrend, it is typically considered a sign of potential reversal, indicating that the sellers are losing ground and the buyers are gaining strength.

Key Characteristics of the Dragonfly Doji

Appearance: A Dragonfly Doji has a small or non-existent body with a long lower shadow and no upper shadow.

Market Context: It is most significant when it appears after a prolonged downtrend or at a support level, signaling a potential bullish reversal.

Psychological Implication: This pattern indicates a struggle between buyers and sellers where the buyers managed to push the price up to the opening level, reflecting growing bullish sentiment.

How to Trade Using the Dragonfly Doji

Confirmation is Crucial

Never rely on a single Dragonfly Doji to make your trading decision. Wait for confirmation in the next or subsequent candlesticks. A bullish confirmation could be a gap up or a long-bodied bullish candle following the Doji. This confirmation suggests that the buyers are indeed taking control and that the trend may reverse.

Context Matters

The Dragonfly Doji is a versatile pattern, but its interpretation depends significantly on the market context. When it appears at the bottom of a downtrend or a support level, it’s typically more reliable. It’s also worth considering the volume; higher volume on the confirmation candle provides additional validation.

Setting Stop Losses

To manage risk effectively, set a stop loss just below the low of the Dragonfly Doji. This strategy ensures that you’re protected against the possibility of a false reversal signal.

Combine with Other Indicators

Enhance the reliability of the Dragonfly Doji by combining it with other technical analysis tools. Oscillators like RSI or MACD can provide additional confirmation. For instance, an oversold RSI reading coupled with a Dragonfly Doji might indicate a strong potential for a reversal.

Be Patient and Disciplined

The Dragonfly Doji, like any other technical indicator, is not foolproof. It requires patience and discipline to wait for the right confirmation and context. Avoid the temptation to make impulsive decisions based solely on the appearance of this pattern.

Continuous Learning

Successful trading involves continuous learning and adaptation. Keep a trading journal to record the outcomes of your Dragonfly Doji trades and learn from both successes and failures.

What You Need to Know

The Dragonfly Doji is a powerful tool in the hands of a knowledgeable trader. Its significance increases when combined with other indicators and in the right market context. However, it’s not a standalone signal for making trading decisions. Understanding the nuances of this pattern, practicing disciplined trading, and continual learning are key to harnessing the full potential of the Dragonfly Doji.

In conclusion, the Dragonfly Doji is more than just a candlestick pattern; it’s a narrative of market sentiment, a tale of tug-of-war between bulls and bears. Mastering its interpretation and application can significantly enhance your trading strategy. As you continue your trading journey, let the Dragonfly Doji be a guide, leading you through the complexities of the market with the promise of insight and the potential for profit.

2 Responses

Kind of an interesting candlestick. I have had a huge win rate with this candlestick. I mostly trade the ones that are having a body bigger than the adjacent candles. Nice article. It helped to remind me of how powerful candlesticks can be in trading

Wow! Such a beautiful subject!

It is amazing how something so small as a dragonfly stick thingy can be of such large benefits if understood and taken action upon at the same time.

Very very interesting and helpful. Your blogs are like a new chapter i look forward to every morning when having me coffee.

Thank You Very Much..

=)