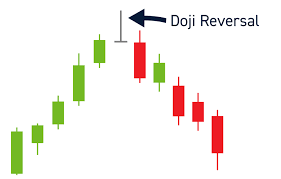

A candlestick pattern to analyze trend reversals on the market is Doji candles. Traders can use a Doji candlestick to see past price movements in order to make successful foreign exchange trading decisions. Using a Doji candlestick pattern to measure the open and closed prices of currency pairs, it is possible to confirm any price point that might have been higher or lower.

Doji Candlesticks: How to Trade Them?

1. Create an account with a forex broker

Open an account with a forex broker before trading with the Doji Candlestick pattern. To trade on the forex market, look for brokers with the right certifications and a wide range of tools. To open an account, provide the broker with the necessary documents once you find a platform that suits your needs. RECOMMENDED FOREX BROKERS 🏆 Looking for the best forex broker? I use and recommend these brokers. 🎖IC Markets – #1 True ECNforex brokerr with the lowest spreads 👉 Sign up here: https://bit.ly/2W38hd2 🧩 XM – #2 Best STP Broker With High Volume. 👉 Sign-up link: https://bit.ly/3tX28vY

2. Choose the FX pair you want to trade

Once you have opened a forex account, you should research the currency pairs trading in the market and their historical price movements. Suggest a pair or pairs based on their past performance and potential future direction.

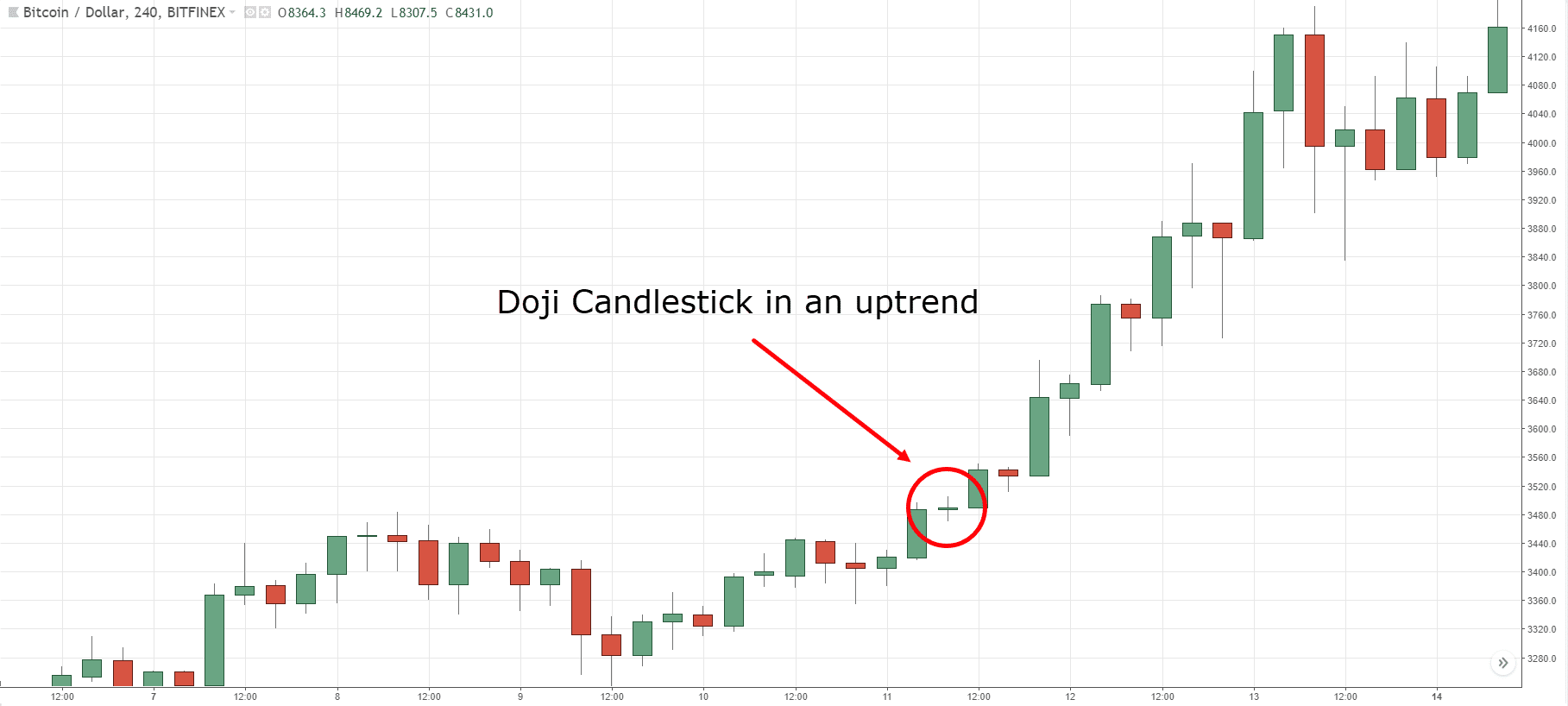

3. Monitor FX pair prices with a Doji Candlestick pattern

Once you decide which currency pair(s) to trade, use one of the best candlestick patterns, the doji, to track the current market price. You can decide your next trading step based on whether you receive long or short signals from Doji Candlesticks.

4. Enter with a Doji Candlestick

If the Doji Candle is almost the same price on both the closing and opening of the market, it indicates that a possible bullish reversal has occurred. Once the price signal is confirmed, you can buy the currency pair and trade for a long position.

5. Exit with a Doji Candlestick

It indicates that a bearish reversal may be imminent when the Doji Candlestick is at the top of an uptrend after staying in the position for some time. You can exit the market by selling your currency pairs when you confirm the price signal. This will minimize your possible losses by trading for a short position.

What does a Doji tell traders?

In technical analysis, a Doji candlestick indicates that a reversal is about to occur—the opening and closing price of a currency pair and the following low and high prices. In trading, a bearish doji indicates a reversal in a downtrend, and a bullish doji indicates a reversal in an uptrend.

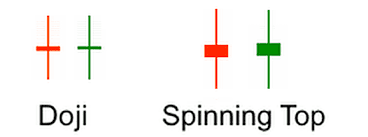

Why is a Doji different from a spinning top?

Doji and Spinning Top are reversal signals indicating the current market direction is changing. However, Doji Candlesticks are smaller than Spinning Top Candlesticks, with smaller lower and upper wicks. On the other hand, the spinning top candlesticks have larger bodies with longer wicks and upper and lower wicks.

Bottom line

A Doji Candlestick is more appropriate for currency pairs with closing and opening prices close to one another; Doji Candlesticks are more appropriate. Doji candlesticks also have small wicks because there is not a huge difference between the high and low prices of the currency pair at the moment. In addition to forming a plus sign, dojis also appear as spinning tops.

10 Responses

Thank You for the helpful information on candlesticks.

I am a student at godloveuniversity and i love all the content your course has to offer.

I definitely recommend it to the world.

The best mentor in the industry!

Keep up the great work.

Hello there,

Thank you so much for your kind words and for taking the time to share your positive experience with our course at Godloveuniversity. We’re thrilled to hear that you found the information on candlesticks helpful and that you’re enjoying the content we offer.

As a student committed to learning and growing in the Forex market, your enthusiasm and recommendation mean a great deal to us. We are constantly striving to provide comprehensive and insightful educational materials, and feedback like yours is incredibly motivating.

Please feel free to reach out if you have any questions or need further assistance as you continue your trading journey. Also, keep an eye on our upcoming modules and resources; we’re always adding new content that you might find valuable.

Thanks again for your support and for being part of our community. We look forward to continuing to support you in your Forex education and trading endeavors!

Best regards,

Godlove University

Technical analysis utilising candlestick patterns is a great way to maximise profits on your trades. great article thanks.

Thank you for your positive feedback on our article! We’re delighted to hear that you found it valuable.

You’re absolutely right about the effectiveness of technical analysis, especially when it involves the use of candlestick patterns. Candlestick charts are indeed a powerful tool in a trader’s arsenal, providing deep insights into market sentiment and potential price movements.

Very interesting article. What, in your opinions, are the top 5 candle stick patterns to watch out for that can show you when to enter a trade?

Thank you for your kind words and for engaging with our article! I’m delighted to hear you found it interesting.

Regarding your question about the top 5 candlestick patterns to watch for in trading, here they are:

1. **Bullish Engulfing Pattern:** This pattern occurs at the end of a downtrend. A small bearish candle is followed by a larger bullish candle, completely engulfing the previous one. It suggests a potential reversal from bearish to bullish sentiment.

2. **Bearish Engulfing Pattern:** The opposite of the Bullish Engulfing, this pattern appears during an uptrend. A small bullish candle is followed by a larger bearish candle, signaling a possible shift from bullish to bearish momentum.

3. **Hammer and Inverted Hammer:** The Hammer, appearing in a downtrend, and the Inverted Hammer, found in an uptrend, both indicate potential trend reversals. The Hammer has a small body with a long lower wick, while the Inverted Hammer has a small body with a long upper wick.

4. **Shooting Star and Hanging Man:** These patterns are similar in appearance but occur in different contexts. The Shooting Star appears in an uptrend and indicates a potential bearish reversal, while the Hanging Man, found in a downtrend, suggests a bullish reversal. Both have small lower bodies with long upper wicks.

5. **Doji:** The Doji is recognizable by its small or absent body, with wicks of similar length on both sides. It signifies market indecision. When found after a prolonged trend, it can signal a possible reversal, as neither bulls nor bears have gained control.

Each of these patterns provides valuable insights into market sentiment and potential reversals. However, it’s crucial to use them in conjunction with other technical analysis tools and indicators for confirmation. Also, always remember to consider the broader market context when interpreting these patterns.

Once again, thank you for your interest and feel free to reach out with any more questions or topics you’d like us to cover!

Best regards,

Godlove University

Thank you, I have some little confusions, perhaps you could helping me?

Sometimes i see this doji stick + and then when i look again after maybe 15-30 mins that same stick has disappeared. May i know why this happens?

Thanks alot

Anu

Hello Anu,

Thank you for reaching out with your question. It’s great to see your active engagement and curiosity about Forex trading charts.

Regarding your observation about the doji candlestick (which you’ve referred to as a “doji stick +”), it’s important to understand that these are a part of candlestick charting used in Forex trading to represent price movements. A doji candlestick is typically characterized by a small body, indicating that the opening and closing prices are very close, with wicks on either side.

The reason you sometimes see a doji candlestick appear and then disappear after 15-30 minutes can be attributed to the ongoing trading activity and how candlesticks are formed. Here are a few points to consider:

Real-Time Price Fluctuations: Forex markets are extremely dynamic, and prices fluctuate constantly due to ongoing trading activities. Candlestick charts are updated in real-time to reflect these price movements.

Time Frame of the Chart: If you’re looking at a chart with a shorter time frame (like a 1-minute, 5-minute, or 15-minute chart), each candlestick represents the price action over that specific period. As new price data comes in, the current candlestick can change its form until the period it represents is completed.

Temporary Formations: During its formation period, a candlestick can show different patterns, including a doji. However, as trading continues and new prices are recorded, the candlestick can evolve into a different form, such as a bullish or bearish candle, depending on the market’s movement.

Technical Glitches: While less common, sometimes technical issues with the trading platform or data feed can temporarily display incorrect candlestick formations, which are corrected once the issue is resolved.

To better understand these patterns, I would recommend keeping an eye on the time frame of your chart and observing how candlesticks develop over different periods. It’s also helpful to use other technical analysis tools in conjunction with candlestick patterns for a more comprehensive market analysis.

If you have further questions or need more detailed explanations, feel free to ask. We’re here to help!

This blog post has more than just the Candlestick,it’s a full forex course

Starting with a choice of brokers and how to sign up,taking through a strategy(indicating when to enter and exit a trade)..Thus can be adapted by any one as their strategy and they will be profitable 📈 with this..cheers Admin

Seeing all these candlesticks on the chart can be really confusing. Thank you for an insightful blog, I now know how to analyze trend reversals on the market, and see past price movements.

I’m happy to know that a Doji Candlestick is more appropriate for currency pairs with closing and opening prices close to one another; Doji Candlesticks are more appropriate.