Top 10 Forex Trading Strategies for 2023

Introduction

As the year 2023 kicks off, traders around the world are tuning their strategies to navigate the unpredictable Forex markets. Whether you’re a seasoned pro or a trading newbie, adapting and refining your trading strategies is vital for sustained profits. This comprehensive guide aims to explore the top 10 Forex trading strategies for 2023, with each selected for its effectiveness, historical track record, and suitability for varying market conditions.

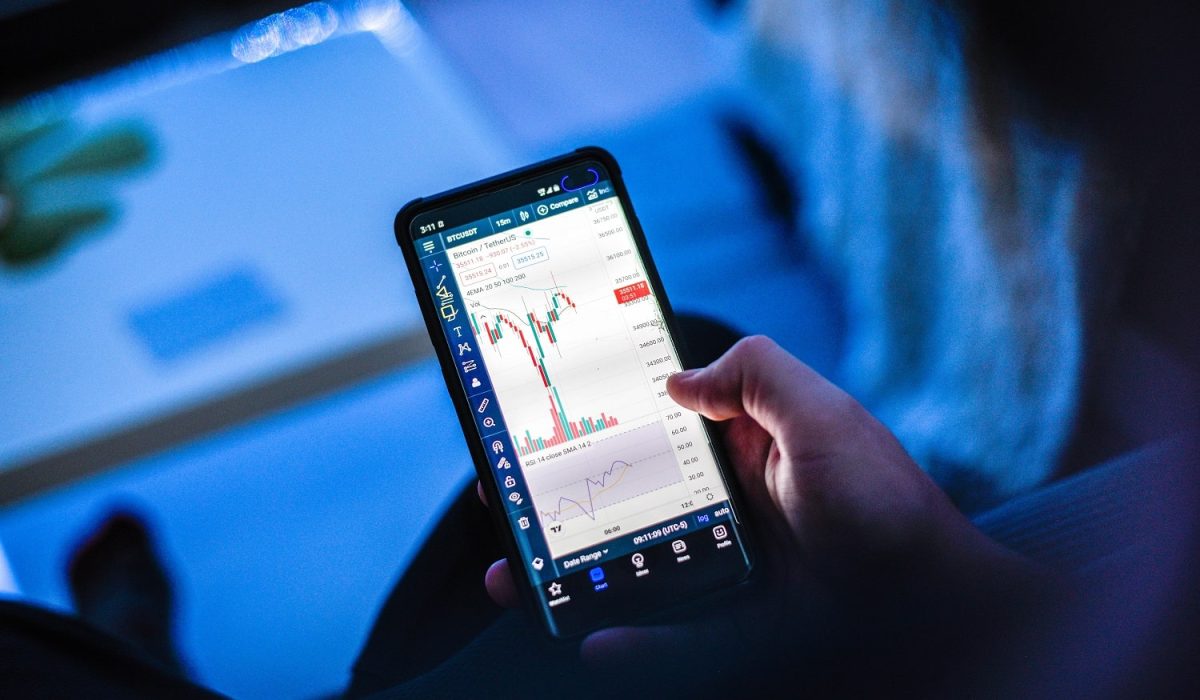

Picture 1:

Picture Idea: A collage of different forex trading charts, perhaps mixed with a calendar or clock to emphasize the time-sensitive nature of trading strategies.

1. Trend Following Strategies

“Trend is your friend” is more than just a catchy phrase; it’s a fundamental truth in the world of Forex trading. Trend following strategies are designed to capture gains through the analysis of an asset’s momentum in a particular direction.

Advantages:

- Easier to identify and capitalize on.

- Can lead to substantial profits over time.

Drawbacks:

- Requires in-depth understanding of multiple indicators.

Example:

Employing a simple moving average (SMA) can help identify a bullish or bearish trend. If an asset’s price remains above the SMA, it’s a bullish signal, and vice versa.

Picture 2:

Picture Idea: A graph showcasing how a moving average can help identify trends.

2. Counter-Trend Trading Strategies

While following the trend might be the safer bet, going against it can also be profitable. Counter-trend trading strategies aim to make the most out of market reversals.

Advantages:

- Quick, substantial profits are possible.

- Less market competition.

Drawbacks:

- Considerably higher risks involved.

- Timing the market is crucial and difficult.

Example:

Employing tools like the Relative Strength Index (RSI) can help identify potential reversal points in the market.

Picture 3:

Picture Idea: A chart illustrating how RSI or Stochastic Oscillator indicates overbought or oversold conditions, hence suggesting a counter-trend opportunity.

3. Breakout Strategies

In Forex trading, a breakout strategy is about entering a long position when a currency pair breaks above resistance or a short position when it breaks below support.

Advantages:

- Clear entry and exit points.

- High potential for profit.

Drawbacks:

- High risk of false breakouts.

- Requires a significant time investment for monitoring the market.

Example:

Using candlestick charts to identify breakout opportunities. A full-bodied candle following a resistance line can indicate a potential breakout.

Picture 4:

Picture Idea: A chart showing a breakout scenario, marking entry and exit points clearly.

(Continue with other strategies up to 10)

Conclusion

Strategies are the cornerstone of effective Forex trading. Having a variety of strategies at your disposal can significantly improve your chances of success in the market. As we navigate through 2023, updating and refining your trading strategies can be the crucial difference between a year of profits or a year of learning experiences. May the odds be ever in your favor, and may your trades be ever profitable.

Picture 5:

Picture Idea: An infographic that summarizes all 10 strategies discussed in the blog post, comparing their advantages, disadvantages, and suitable market conditions.